Productivity during uncertain times: Investment behavior of credit-constrained industries

In the decade since the global financial crisis, renewed interest has emerged in how uncertainty affects the real economy.

However, identifying the causal links between uncertainty and macroeconomic fluctuations using aggregate data has been challenging for researchers since uncertainty tends to increase during recessions.

A group of international researchers from four countries, including Prof. Sangyup Choi of Yonsei University, have produced new empirical evidence showing that heightened uncertainty slows down productivity growth, and this mechanism depends crucially on whether firms are credit constrained.

Specifically, the study finds that when uncertainty increases, the productivity of industries heavily reliant on external finance suffers more than that of less credit-constrained firms. Industries in a credit crunch have a reduced share of more productive capital as well as productivity growth.

The results have important policy implications—that governments should consider implementing policies to raise productivity growth during uncertain times as well as policies to address weak corporate balance sheets.

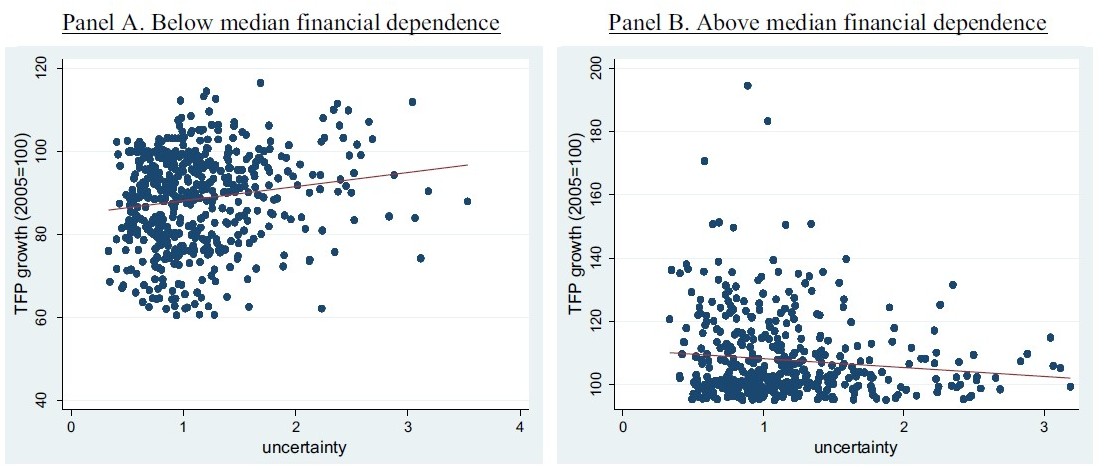

Uncertainty and Total Factor Productivity (TFP) growth: correlation at industry level. The clusters show that average productivity growth after an uncertainty increase tends to be negative for industries more reliant on external finance (Panel B) than for those less reliant (Panel A).

Uncertainty and Total Factor Productivity (TFP) growth: correlation at industry level. The clusters show that average productivity growth after an uncertainty increase tends to be negative for industries more reliant on external finance (Panel B) than for those less reliant (Panel A).

"Alleviating credit constraints is the key to restoring productivity growth under heightened uncertainty," said Prof. Choi. "Credit constraints play an important role in shaping the effect of an increase in uncertainty on productivity growth."

The study is the first attempt to use both cross-country data and sector-level data to study the ripple effects on the macro-economy of uncertainty shocks. Specifically, it uses information for 25 industries from 18 advanced economies during 1985–2010.

The study’s key finding is that uncertainty—as measured by stock market volatility—is more likely to generate poor productivity outcomes for industries that are reliant on external finance than on those that are not.

This effect occurs mostly because of a cut in the share of productivity-enhancing investment, such as information and communications technology (ICT) capital or spending on research and development, which faces greater liquidity risks.

The study draws on the theory that credit-constrained firms facing future uncertainty in aggregate economic conditions make less productivity-enhancing investment. The research uses ICT investment to represent the mechanism through which uncertainty interacts with credit constraints to affect productivity growth.

Overall, the effect of uncertainty on industry total factor productivity growth varies depending on the degree of external financial dependence and tends to be negative for industries that rely on external finance.

Updated in Dec 2018

Recommended Articles

Professor Sangyup Choi and Myungkyu Shim

Researchers Show How Uncertainty in Inflation Expectations Affects Economic Growth

Professor M. Jae Moon

The evolution of E-Governance: Professor M. Jae Moon’s contribution

Professor Jeonghye Choi

Studies Show Social Interaction Is Bigger Motivator than Money for Sustained Purchase Behavior